What are the latest South African wine category trends? Vinimark’s recent market review has the answers

Leading local wine distributor Vinimark has released its latest local market review, covering off consumption sales out data captured between January and December 2023. Compiled by Oelof Weideman, Head of Insights and Business Advisory at Vinimark, the review reveals moments of optimism tainted by concerns that will carry us into the rest of 2024, and possibly beyond.

If you’re a fan of ‘good news first’, be reassured to learn that wine sales in certain segments show healthy signs of growth. However, this may appear positive only when seen in isolation; it does beg the question of robbing Peter to pay Paul, as a growth in one area could be the consequence of a retraction in another.

According to data from Circana, ‘bag-in-box’ wine is performing well. Once snobbishly dismissed by oenophiles as cheap and nasty, not all boxed wines are made equal, and nowadays, small batch winemakers are making the cardboard packaging – which is lighter and more sustainable than glass – newly sexy through a mix of self-conscious irony and sincerity.

If concerns about permissible bottle weight, carbon footprint, and new export legislation deepen, we may very well see more and more ‘bag-in-box’ wine carrying fresh cachet and rising to meet the growing demand. The volume sales for ‘bag-in-box’ wine have increased by 15% since 2019. The volume is currently sitting at 94,8 million litres sold in 2023, compared to approximately 90 million litres sold in 2022 and only 55 million litres in 2019. Volume has almost doubled in five years.

Sales of wine in a glass bottle have decreased from 61 million litres in 2022 to 59,3 million litres in 2023 – that’s down by 1,2%. It may be that certain consumers have migrated to ‘bag-in-box’ wine after feeling the economic pinch in post-Covid, recessionary South Africa, but, according to Weideman, ‘the increase in box wine is most likely coming from new consumers outside the wine category as the total volume increase in box wine is much more than the decrease in glass.’

Or they may simply be cutting back on general consumption of wine, savouring a single glass (instead of two or more glasses) alongside other drinks. What is clear is that 750ml of still wine packaged in a glass bottle is feeling the pressure.

But there’s hope for alternate packaging. Like box wine, Tetra Pak wine is a rising category. Reading between the lines of the sales data, Tetra Pak seems to resonate more with consumers than wine in PET plastic bottles. Sales of Tetra Pak containers increased by 19,7%, with 14,9 million litres sold in 2023, up from 11,8 million in 2022; PET packaging increased sales by just 5,3%, and with a year-to-date increase to 2,8 million litres sold last year, compared to 2,6 million in 2022.

South Africans are indeed under economic pressure. The unemployment rate remains very high. According to Stats SA (Department of Statistics South Africa), in Q3 of 2023, there were 7,8 million people who were unemployed, 3,2m discouraged work seekers, and 13,1m not actively employed, leaving only 16,7m South Africans in employment.

Other factors to consider include the very high inflation rate on staple foods, and, while tourist numbers are rising steadily, we are not yet back to 2019 levels. In December 2023 the figures were still 41,8% below the pre-pandemic numbers with 862 460 visitors in December 2023 compared to 1 481 183 in December 2019.

It looks as though consumers in the lower income brackets might be feeling the pinch more than the other lifestyle measures, judging by sales in the sub-R80 per bottle range that have decreased since 2019 and are down since last year too. Over the last 12 months there has been growth in the R100-R200 category and more substantial growth in the +R200 category.

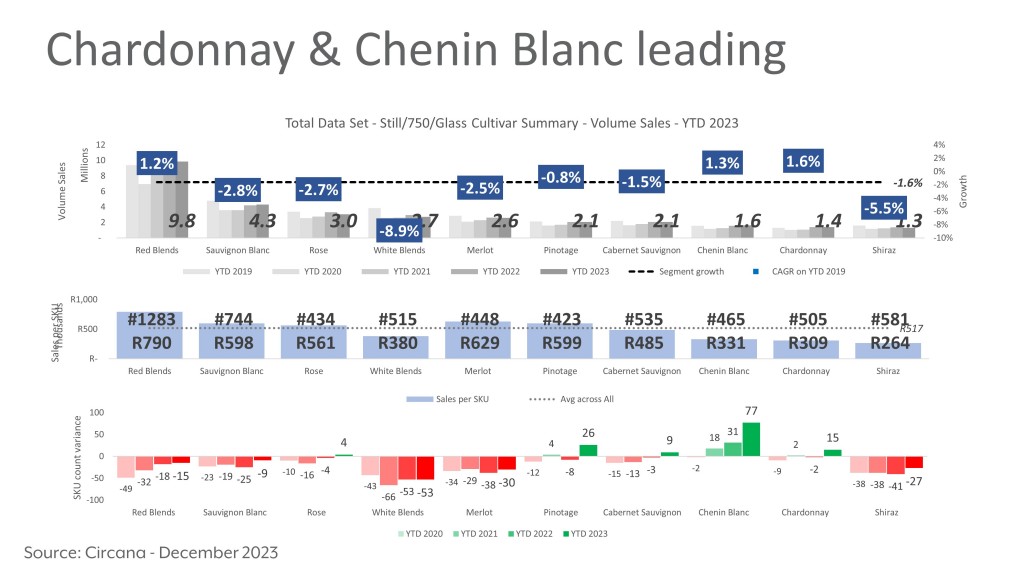

Chardonnay and Chenin Blanc are leading in growth when it comes to white wine, with sales in Sauvignon Blanc and white blends taking a slight downturn even though Sauvignon Blanc is still the largest single cultivar. Red blends are gaining ground and experiencing growth, but Cabernet Sauvignon, Shiraz, Merlot, Pinotage and Rosé are in a modest decline. Pitting red vs white, red is still the more popular choice with consumers.

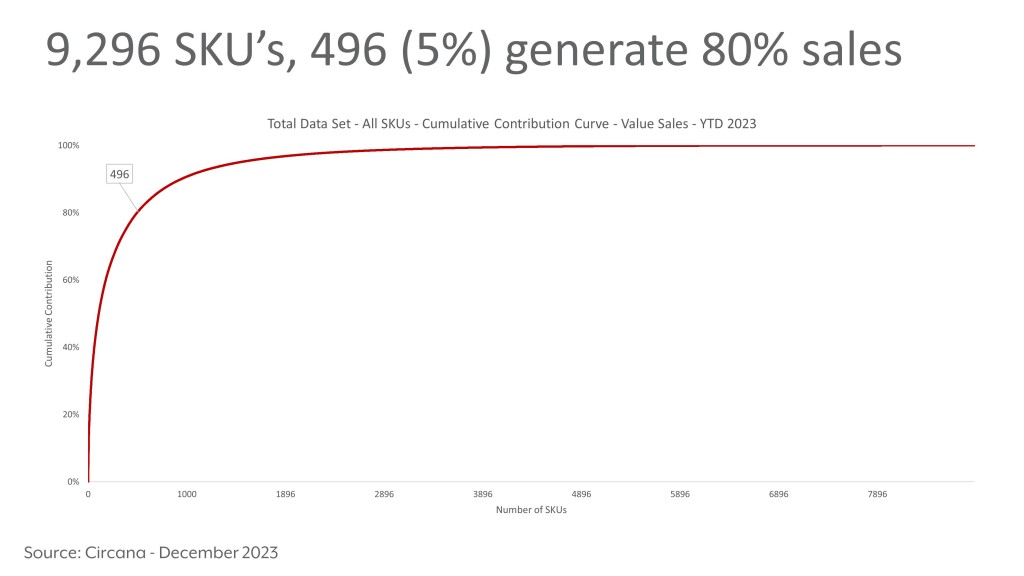

Of the 1121 brands surveyed, it is the top 4% that generate 80% of the sales; and of the 9296 SKUs on the market, a mere ‘handful’ – 496 to be precise (5%) – are the ones generating 80% of the sales.

This is in line with research by NielsenIQ (Source: NielsenIQ 2022 Brand Balancing Act) which indicates South African consumers, even more so than global consumers, prefer big brands and are more likely to seek them out for purchase. It is a reliable observation that, when budgets are tight, people prefer to buy what they know and trust, rather than take risks on something they might not like.

As we approach the second quarter of 2024 it will be important to observe how the trends Weideman has identified continue to impact winemakers and drinkers alike.

Find out more about Vinimark by visiting www.vinimark.co.za.