It’s more than half-way through 2024 – how is the South African wine industry faring this year?

It’s more than half-way through 2024 – how is the South African wine industry faring this year?

If the biggest national stockists have the capacity to stock only 3 000 to 3 500 wine products, and yet there are 6 814 active products on the market, then wine brands face a hefty challenge. And then, out of these active products, there are 364 products that drive the majority of sales. Moreover, while South Africa has 1 143 wine brands, it is only a mere handful, just 50 of these brands, that generate 80% of the business.

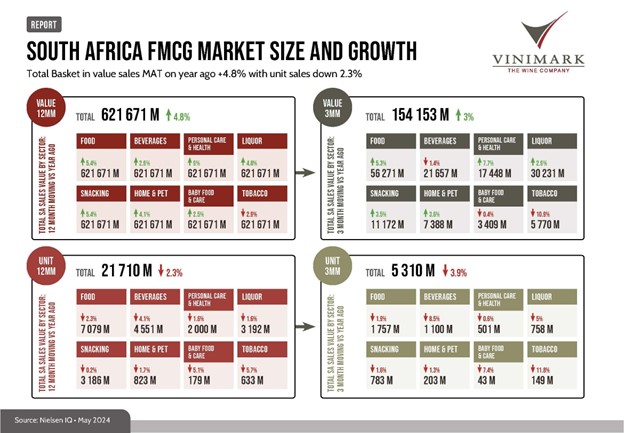

Thankfully, the wine category as a whole is growing, albeit at a snail’s pace. With only 4,8% growth in the past six months, this micro-uptick in wine is in step with broader consumer trends in a somewhat depressed market where personal care and health lead general FMCG sales.

These insights into the first six months of 2024 were drawn from a mid-year review compiled by leading distributor Vinimark. Released in August 2024, Vinimark’s market review was researched and analysed by Head of Insights & Business Advisory Oelof Weideman and shows where the shifts and gaps sit.

Weideman points out the polarised position that South African wine brands are in this year. In general, they are either growing at 20% or declining at 10 – 15%. He explains a boost in sales is often a response to brands starting to promote and market their products for the first time.

‘Midway through 2024, we see Rosé, Cabernet Sauvignon and Pinotage opening up with new products entering the category. The numbers also show drinkers are starting to prefer Red Blends and Chardonnay over every other category,’ Weideman states.

While KZN is the province showing the biggest growth, it is important to note this is primarily driven by Bag in Box (BIB) and Tetra Pak products, rather than 750ml bottles. Although the Eastern Cape does show impressive numbers, sales are nearly 100% attributable to Sedgwick’s Old Brown.

On the surface, the numbers appear to suggest that Sparkling Wine is doing better than Still Wine, but it is important to bear in mind that the bubbly in a can by Chateau Del Rei is included in the Circana sales statistics for the whole category. Without this product, bottled Sparkling Wine sales are equal to Still Wine.

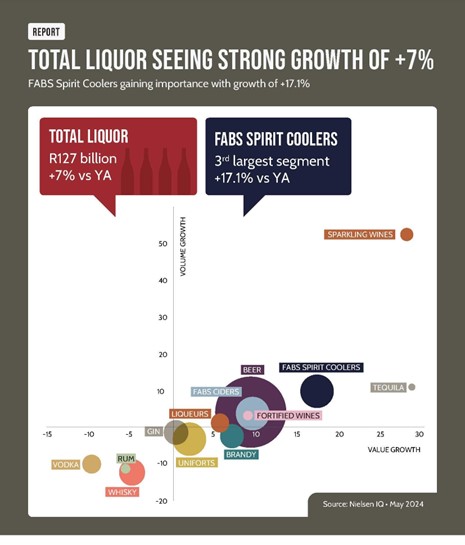

An encouraging trend sees Still Wine sales approximately equal to Flavoured Alcoholic Beverages (FAB) and Spirit Coolers. Another key insight shows that in this category Consumer Price Index (CPI) remains steady, while Producer Price Index (PPI) declines. It’s important to consider most of the growth in Flavoured Alcoholic Beverages (FAB), Spirits and Coolers is a result of item extension.

An interesting trend shows spirit-based brands are starting to play in the FAB and Coolers field. Shop shelves are stocked with more and more flavours and styles. Although this may look like impressive growth at face value, it’s crucial to understand item extensions can easily lead to cannibalisation. Rather than improving overall sales, bringing out a new product in a different pack size can simply steal sales from the core offering.

‘While the wine industry faces significant challenges, this is to be expected in our current financial climate.’ says Weideman. It will be interesting to see how winemakers find new opportunities as we enter the second half of 2024’s financial year.

Find out more about Vinimark by visiting www.vinimark.co.za

/ends.